What exactly are particular facts that can apply to your own mortgage repayments?

Looking to purchase a home and have home financing some time in the future? Understand what you will be joining which have is the reason homeloan payment calculator. Focusing on how much their monthly mortgage payments would be is a must of having home financing that one may afford.

All of our mortgage payment calculator shows you how far you will have to spend each month. You could examine problems for different off costs numbers, amortization episodes, and you can variable and fixed home loan prices. In addition, it works out your home loan default insurance premiums and you can property import income tax. Advertising Revelation

To use the fresh calculator, start by entering the cost, upcoming see an amortization months and you will mortgage rates. The brand new calculator suggests a knowledgeable prices in their state, but you can include another price. The new calculator commonly today guide you exacltly what the mortgage repayments often getting.

Automagically, the borrowed funds commission calculator will show five various other monthly installments, with respect to the measurements of your own downpayment. It can immediately calculate the expense of CMHC insurance. You can alter the size of your deposit and the fee volume observe exactly how the regular commission could be influenced

The calculator also demonstrates to you what the residential property import tax commonly end up being, and you can around exactly how much necessary for settlement costs. You could utilize the calculator so you can imagine your own complete monthly expenditures, see what your instalments might be if the mortgage pricing go up, and feature exacltly what the an excellent equilibrium was through the years.

If you’re to shop for an alternate domestic, it is best to use new calculator to determine what you can afford earlier considering real estate postings. When you find yourself revitalizing otherwise refinancing and you will be aware of the complete quantity of the loan, utilize the Renewal or Re-finance tab to help you estimate mortgage payments in place of accounting to possess a deposit.

Yes, the mortgage repayment calculator is free. In fact, the hand calculators, articles, and you will rate assessment dining tables is actually 100 % free. brings in money using advertising and fee, in place of because of the asking profiles. I provide a low prices in for each state given by agents, and invite them to visited users on the internet.

How come your own monthly calculator has actually four articles?

We think it’s important on precisely how to evaluate Laird loans the options front from the top. We begin new calculator of the explaining the fresh five typical selection for down payment scenarios, nevertheless aren’t limited by people selection. I and enables you to will vary amortization several months as well as interest levels, very you should understand just how a variable against. fixed mortgage price transform your payment.

How do payments differ by state inside the Canada?

Extremely home loan control into the Canada try uniform along the provinces. This includes minimal downpayment of 5%, together with limit amortization several months thirty-five ages, such as. Although not, there are numerous financial laws and regulations one will vary anywhere between provinces. Which desk summarizes the distinctions:

What exactly is CMHC Insurance policies?

CMHC insurance rates (or home loan default insurance) handles lenders regarding mortgage loans you to definitely standard. CMHC insurance is mandatory for everyone mortgages within the Canada with off repayments out of less than 20% (high-proportion mortgages). This really is an added cost to you, that will be calculated because the a percentage of overall home loan matter. For more information on mortgage standard insurance policies, delight discover all of our self-help guide to mortgage standard insurance rates (CMHC insurance rates).

What’s an amortization agenda?

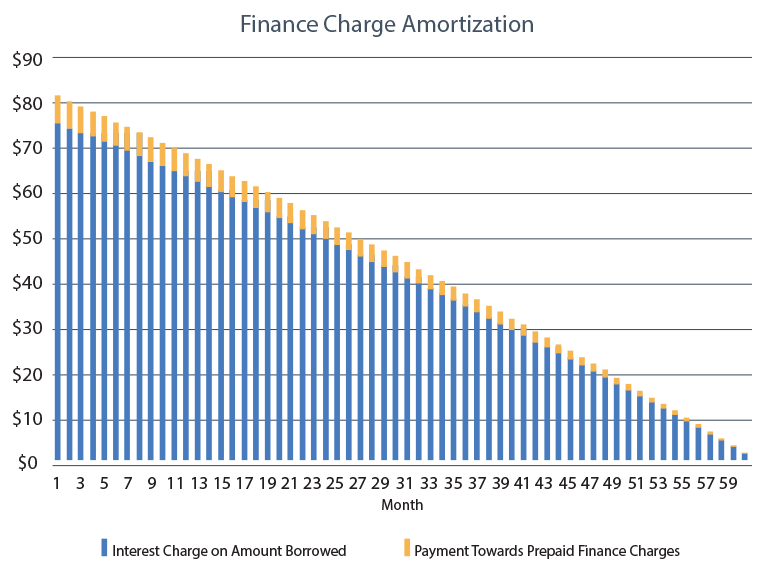

An amortization agenda suggests your monthly obligations through the years and have now means the new portion of for each fee paying the principal compared to. attention. The most amortization for the Canada was twenty five years with the down money below 20%. The most amortization several months for all mortgages is actually thirty five age.

Whether or not your amortization can be 25 years, the term might possibly be far smaller. With the most well-known term when you look at the Canada becoming 5 years, your amortization was upwards having renewal ahead of their mortgage is actually repaid, which is why the amortization agenda explains the balance regarding the mortgage at the end of your identity.