Principal and notice: how exactly to pay-off their home loan faster

Your mortgage principal refers to the count you’ve borrowed and can need certainly to pay off to the bank as time passes. Paying your own home loan prominent can not only bring you closer in order to purchasing your home outright and having regarding obligations, but probably make it easier to pay less within the focus costs throughout the years. You will find some mortgage enjoys and you can options that be able to help you pay back your house loan reduced.

Why is your loan dominating essential?

The financial prominent is an additional title for cash you borrowed your bank on your own home loan. If for example the financial software is accepted, you invest in pay back their home loan dominant along with interest charge during the normal instalments along side loan identity, that may be counted into the age.

Your house loan’s dominating is essential because it’s accustomed assess the attention costs that make up your property mortgage cost. The fresh new shorter dominating that’s due on the financing, the fresh new less notice you’ll be billed that month (otherwise fortnight, otherwise month).

Their mortgage principal is even familiar with work-out the security in the a property. The collateral is the most recent worth of the house, without a great home loan prominent. Their security is how much of your possessions you possess downright, and might be useful whenever refinancing your home mortgage, investing in the next possessions, or being able to access a line of credit.

The simplest way to pay back the main in your financial is always to build typical dominant and you can attention mortgage payments. Looking at a report about a home loan’s payments throughout the years, you could notice that in the beginning most for each payment is made up of appeal, that have a lot less going with the paying off the main. However, over the years, the latest proportion slowly shifts from the other-direction, with each installment paying off more of their leftover prominent.

Analogy

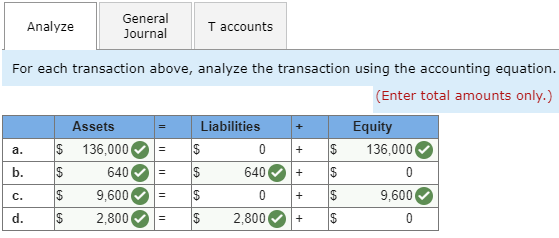

Believe taking out an excellent $350,100000 home loan, agreeing while making month-to-month dominating and you will focus repayments more a twenty-five-seasons label. Just in case mortgage away from cuatro.75 %, you would be investing $ a month, divided the following toward earliest three months:

A lot more of these types of early repayments wade on covering the interest fees than just paying off the borrowed funds dominating. But not original site, by the end of your own mortgage label, the exact opposite holds true:

Source: RateCity Mortgage Calculator. This type of answers are estimates for demonstrative motives merely, plus don’t account for costs, costs, otherwise interest transform.

Whilst you have the option adjust in order to attract-simply money getting a restricted day, or even need a short-term payment holiday, you simply will not feel paying the mortgage principal during this time. If you’re these solutions you certainly will offer some monetary recovery from the small identity, could cause paying even more altogether attract fees with the your property along side overall.

How will you pay-off the principal in your financial quicker?

You will find some home loan available options which is often capable help you repay your own home loan dominant shorter and you can possibly save on notice fees.

Even more payments

Should your financial makes you generate more costs on your mortgage also the scheduled costs, so it more funds can go straight into the paying off your home loan dominating.

Most lenders charges attention monthly, fortnightly otherwise each week together with your mortgage payments, notice is often computed on a daily basis. Because of this the more tend to you could make more money and lower your own a fantastic financial equilibrium, the greater you might compress their appeal fees, no matter if only by a tiny count at a time. The more you might compress your own notice charges, the more each and every mortgage payment can go on the investing of their outstanding prominent number, speeding up how you’re progressing on the paying off their home loan.