Military Reservist Monetary Burns off Emergency Mortgage System

The fresh Seasoned Business owner Site (VEP) falls under the new Pros Situations Office from Smaller than average Disadvantaged Company Usage. This new VEP links experienced advertisers so you can BusinessUSA and offers listings of home business fund to own pros. Additionally, it offers development lessons, info geared toward this new veteran small company society, franchising opportunities and.

To get into investment solutions, you need to fill out some basic guidance like your location, financial support requires, and also the world you operate in. After you bring the information, you are going to discover a recommendation regarding state and federal resource programs considering your own answers.

Veterans Providers Properties

Pros Organization Functions (VBS) connects pros to investment while offering information as well as training to maneuver about right direction. This private contacting services enjoys wrap-ups which have national SBA 7a Loan providers – creditors which have bodies pledges regarding U.S. Small business Government – or other acknowledged economic intermediaries to incorporate a selection of funding choices to pros across the United states. VBS also helps veteran advertisers create a loans solution to blend qualified and you will important financial support info.

Initiate the procedure when you go to new VBS web site and provide suggestions regarding the providers attention, business strategy and you will NAICS code.

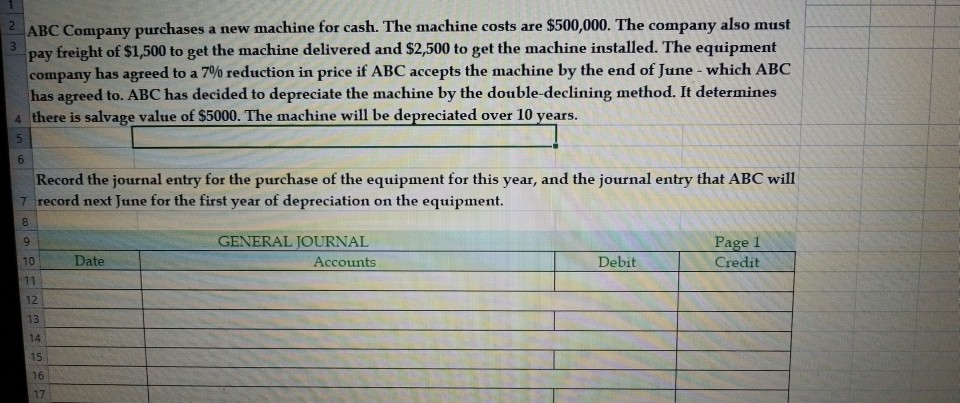

The new Armed forces Reservist Economic Burns Disaster Mortgage system (MREIDL) is intended to permit the required expenses that simply cannot getting satisfied when a significant staff member has been summoned to effective obligations within their role given that a military reservist. The reason for these financing is not to cover lost income or missing payouts. Moreover, the program now offers money from the lowest-interest rates regarding five %.

Getting money more $fifty,one hundred thousand, you should inform you guarantee. Regardless if financing is not typically declined getting lack of collateral, brand new SBA needs individuals so you can hope security that’s available. It is in addition crucial to note that this new submitting months getting brief people to try to get the commercial injury loan direction program starts on go out more personnel initiate effective duty and you may ends up 12 months following worker discharges.

You may incorporate directly to the brand new SBA getting advice. The brand new SBA will send a keen inspector to estimate the price of the destroy once you’ve completed and you may returned the loan software.

SmartBiz

SmartBiz try a san francisco bay area-established market for on the internet small company money. Considering SmartBiz, it can make simple to use having pros to get into funds by creating the application process basic a shorter time-ingesting. This includes a software to have an enthusiastic SBA-recognized loan. It is ideal for veteran entrepreneurs trying build the team on most affordable money.

To help you meet the requirements, you will have a credit score off 600 or maybe more and you may report revenue ranging from $fifty,one hundred thousand and you may $5 million. You to stay business for around 24 months with zero bankruptcies otherwise foreclosures prior to now 36 months. The fresh new pre-certification techniques requires just five full minutes and requirements you to provide earliest guidance. As techniques is done, it entails regarding 7 days up until the fund reach finally your

Experienced Discharge

Experienced Launch try a joint venture partner out of OBDC Small business Fund. It is a low-finances business dedicated to financing California experienced-possessed people. The support boasts funding, consulting and you may marketing assistance.

The organization offers the means to access mini and you can small company label loans that have low charges and you may competitive interest levels. Funds on range of $twenty five,100000 to help you $250,100 arrive and no prepayment punishment.

To make use of, you might give Seasoned Launch a trip, or simply fill out an internet form. Just be sure to promote some basic information about your online business.

Minnesota Reservist and you can Seasoned Business Loan System

The latest Minnesota Reservist and you will Seasoned Business Loan System brings loans https://clickcashadvance.com/payday-loans-fl/san-antonio/ in order to companies that will suffer when their staff are called to active armed forces responsibility. What’s more, it also provides loans to help you veterans going back off effective armed forces duty and would like to created their company.