Find the best No Credit check Possessions Finance Lenders

Step one: Find the right Bank

Finding the optimum bank ‘s the first step toward protecting brand new loan. HomeAbroad is also network your with several educated and you may credible loan providers you to can present you with no credit score assessment investment property financing. They can’t just help you with the necessary cash however, may also guide you from processes.

Step 2: Analyse the house or property

You’ll want a detailed bundle positioned discussing why this new house is a good financial investment. Particularly, exactly how much lowest and restriction local rental will it build, the market value, a price out of resale well worth, etcetera. Not only will this let loan providers see forget the mission, however you will are available across once the a positive and you may genuine borrower.

Arranged the newest down payment count. It is vital to have the downpayment number able, given that that may seal the deal for you. Thus after you’ve a certain possessions planned, keep 20% of the get worthy of able.

Step: Underwriting

Due to the fact lender is actually pretty sure along with your application and you can property’s underwriting analysis procedure will start. Underwriting comes with the information out-of monetary dealings within debtor therefore the financial therefore the threats in the mortgage.

Action 5: Personal toward Assets

With this specific final action, you are going to become the manager of the home. This action comes with signing the loan agreement and you will overtaking the brand new possessions.

DSCR finance are among the best in the class out of non-QM funds. For additional info on they, simply click,

Useful tips to get the Best Lender

step 1. Check around and you will compare other lenders before choosing one to since maybe not all the loan providers provide the same terms and conditions.

step three. Like a professional and you will reliable bank. Handling some body educated try an additional virtue. Not only can you guarantee obtaining right amount out of mortgage for your possessions, but a talented hand may also guide you proper and you can enhance the loan process with worthwhile wisdom into business and field.

HomeAbroad provides a massive and you will splendid community regarding educated loan providers who have helped many home dealers grow regarding bad credit in order to a good credit score by the support traders because of funding specifications. In order to connect which https://speedycashloan.net/loans/payday-loans-for-the-unemployed/ have advanced lenders at no cost, get in touch with HomeAbroad.

Come across Most readily useful Loan providers with no Credit assessment Possessions Finance

cuatro. Discuss the latest terms of the loan before you sign new contract. Its a very extremely important step, since it tend to bear an extended-term affect your money and you will coming resource preparations.

You really must be aware plus contract to the rates, down-payment, monthly payments, mortgage will cost you, and you can closing costs advised from the financial.

Great things about No Credit assessment A residential property Financing

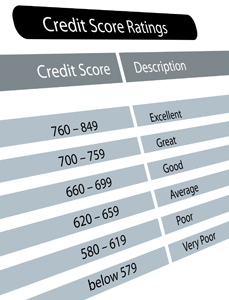

1. These types of funds are based on the worth of the property and you will not on their credit check. Very, you could nonetheless be eligible for such financing when you have a great reduced credit score.

2. DSCR fund are really easy to score and can getting good option for buyers convinced away from promoting confident assets cashflow.

3. These financing are easy to qualify for versus traditional bank loans. On the other hand, individual loan providers do have more flexible financing requirements as they are happy to work with foreign national people and traders with reasonable credit on the getting provided with collaterals.

4. Difficult currency fund was financed by the personal loan providers, maybe not banks. Thus, you can purchase such loans even if the financial institutions possess refused your loan software.

5. Difficult currency loans are used for some intentions, such as for example to order a residential property, refinancing a preexisting mortgage, or even for team financing purposes.