Of several foreclosed characteristics are brought to auction as a way to recover losings on the lender

step one. Residents can also be fork out a lot of your energy on their possessions. In america, home owners exactly who undergo a foreclosures proceeding and then have home financing could possibly remain on their property for almost several days. In the event trust deeds are used, residents possess nearly five months to settle the property prior to it being fundamentally offered. That is certainly a long time to go to for anyone looking to spend on the a difficult possessions.

2. There is absolutely no make sure for the assets position. Property owners going right on through a property foreclosure have nothing leftover to expend toward the house. As to the reasons put money into things you will be going to remove? Of many property foreclosure provides damage that must be repaired up until the possessions are going to be gone back to an effective saleable reputation. Very has actually equipment which need to-be changed to make the device habitable. Some is generally sitting empty for long cycles, hence encourages pests, squatters, and other assets management products and this should be fixed.

step three. The fresh resident might still be on the house. Just because the newest judge property foreclosure techniques has actually complete does not always mean brand new citizen possess leftover the home. If the foreclosures was judicial or non-official issues in certain states. Judicial property foreclosure have a tendency to take much longer to accomplish. Before the home is assigned to an alternate owner, it’s still technically a. Its doing brand new proprietor to help you evict you, which is a separate court proceeding in a few states.

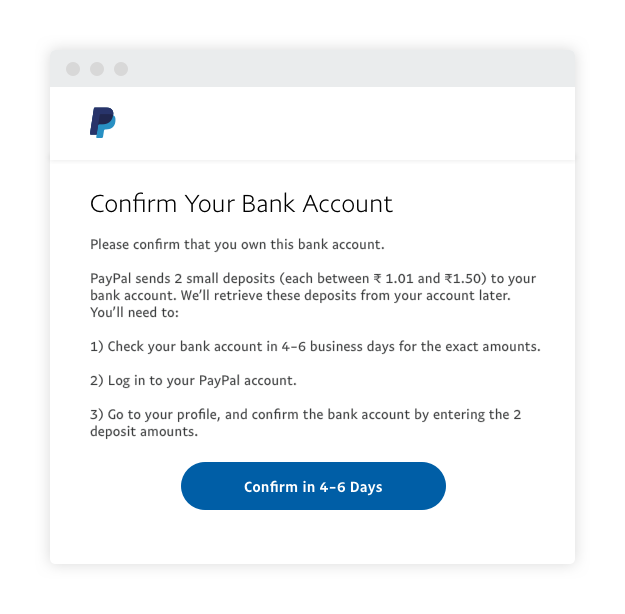

4. You only pay the house completely toward transaction. This step means you to pay-off the cost of the household arranged entirely in the course of purchase. This means you’ll need to provides an excellent preauthorized home loan acceptance during the the absolute minimum to participate the to get techniques. Specific finance companies may require the financing to stay set ahead of your make an effort to make a purchase.

Even although you enjoys a contract in position, really deals has an excellent stipulation which enables a loan provider so you’re able to cancel the fresh new sales when until the closure in reality goes

5. Of several qualities stay empty to have months, if not ages, prior to pick. Even with typical checkups to the good foreclosed assets, https://www.paydayloanalabama.com/citronelle/ once a home is located at the latest REO stage of your techniques, a bona-fide home possessed assets can also be stay bare as opposed to typical restoration for a long time simultaneously. From mildew buildup to damaged pipes so you can taken equipment is happen within a great foreclosed domestic, even with you have started a system to find it. Really properties similar to this can be purchased because-is actually, and thus no resolve demands can be made as part of a-sale contingency.

It commonly requires a low-basic loan to invest in a foreclosure

6. There can be sluggish reaction times of to get techniques. Loan providers create should offload foreclosed services quickly. It is reasonably important to just remember that , they want to build as frequently currency off of the selling that you could. If someone occurs having a much better provide towards the foreclosures, even if you are about to indication the new papers, there clearly was a good chance that you may remove the home your wanted.

eight. Discover financial difficulties with foreclosures. Old-fashioned mortgage loans need the latest worth of the house or property is appraised. Destroy caused while in the a foreclosure lowers this worthy of. Specific mortgages require the the place to find enter a minimum condition of top quality also and you may demand fixes before issuing the credit, and this negates the purchase. Its not all lender now offers a mortgage to possess a distressed property either. Particular buyers could find it difficult to find the credit they need.